How Investments Really Work - part 2

In part 1 we covered how common types of investments - cash, bonds, property and equity - can offer us differing amounts of capital protection, income and capital growth. How do you know what investments are right for you?

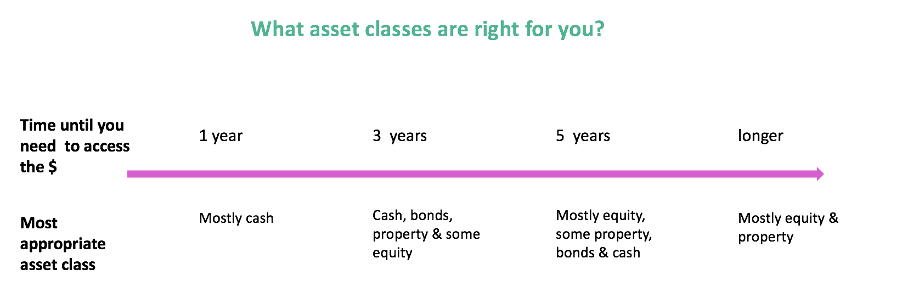

Your goals and the timeline you need to access your money will determine the right mix of assets for you and where you’re at.

In a picture:

The shorter the time until you need access to the money the more emphasis on capital protection and the longer the time frame the more important capital growth is.

The total return you earn on your investments is made of two elements:

Income - like interest or dividends

Capital growth - from the price of your investment going up

Most of your wealth creation is going to come from capital growth, so let’s take a deeper look at why the value of investments change.

For equity/ shares in a company, over the long-term the price of the share goes up because earnings go up. Each company, most likely just like your employer, is constantly trying to sell more, build more, become more efficient so that the earnings grow each year.

As an investor/ shareholder in a company, everybody employed there is working day and night to make you richer.

This same thinking applies to the stock market as a whole, so it’s always helpful to think of the stock market not as some intangible things, but rather as a group of individual companies trying their utmost to grow their earnings and make their share prices go up.

In the short-term there is sometimes volatility as people’s view of the prospects of a company is continually evolving, and that’s why equity / shares are not appropriate if you need to access your money soon.

Property prices are typically less volatile because the rental income stream is more predictable, however the costs of buying and selling property are significantly larger. Investment properties are similar to equities, instead of earnings you get rental income. As the rental income rises so too should the value/price of the property.

Let’s look at a practical scenario: You are saving for the deposit on a house and hoping to have built up the funds in the next year or so. Capital protection is key and you can’t deal with any short-term volatility. Keep your money in the bank and earning the highest interest rate you can find. You buy the house and are immediately entering the capital growth wealth-creating phase. Ideally you want to pay down that mortgage as fast as possible, then start diversifying and considering adding equity / share investment, maybe utilising tax-free savings accounts or other options to set yourself up for an easy retirement.

In conclusion, if you want to get your money working and creating long-term wealth, you need to have some exposure to equity and/or property investment.

Next in this series, we’ll cover how much money you can expect to make from your investments.